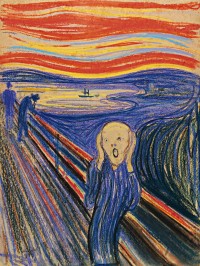

Sotheby’s made auction history when Edvard Munch’s The Scream sold for $119.9 million in New York in May – a new world record for any work of art at auction.

Reduced auction sales and in particular single owner sales led to a decline of 16% in total revenue at Sotheby’s in the first half of 2012. Figures just released show total revenues of $303.9 million, down 18% over the same period in 2011. For the first six months of 2012 net income amounted to $408.9 million, down 16% on the first half of 2011. Net income in the second quarter of 2012 was $85.4 million, a decrease of 33% for the same period last year.

The resolution of a labour dispute with New York unionised art handler negatively impacted on the first half results. Sotheby’s believes that future labour costs have been reset in an attractive and sustainable way. The decline has been partially offset by reductions in total expenses of $8.5 million, or 3% in the first half year.

“Our operating results reflect some tremendous successes, but also reflect the challenging global economy, a tough comparison to the best quarter in Sotheby’s history a year ago, and a competitive climate for high-end consignments,” said Bill Ruprecht, President and Chief Executive Officer. “Demand and prices remain strong, especially at the high end of the market, as reflected in our highest ever sale of Impressionist and Modern Art of $373.3 million in May in New York”. Sotheby’s financial services business grew substantially, he said. Private sales are an increasingly important contributor to revenue stream. The slowdown in the Asian market is comparable to the economy there, but it continues to be very profitable and a source of “substantial opportunity”.

“Art appears to remain an attractive asset for collectors and our consignment pipeline for the Autumn season is very active at the moment” Bill Ruprecht said. “We remain confident in the global art market and will, as always, seek opportunities to broaden and extend the breadth and depth of our relationships with our clients.”